Lee County Property Appraiser Tax Estimator

Lee County Property Appraiser Tax Estimator

- STRAP:

-

22-45-22-01-00000.036A

- Folio ID:

-

10017408

- Address:

-

4290 SUNSHINE BLVD

SAINT JAMES CITY FL 33956

- Property Description:

-

TH S 1/2 OF W 322.60 FT OF

E 1624.32 FT OF N 1/2 OF S

1/2 OF SE 1/4

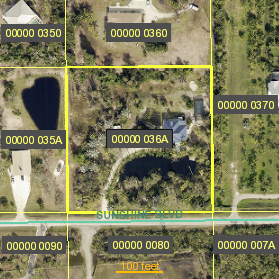

Aerial Photo

Property Description

Estimated Assessed Value:

$ 0

- Assessed Value

-

The Tax Amount shown is an ESTIMATE based upon the Sales Price you

entered and the current ad valorem millage (tax) rate applied to the property. The

actual tax amount for this property may be more or less depending on a variety of

factors including changes to the millage (tax) rate and the inclusion of non-ad

valorem assessments (e.g. garbage, sewer etc.). The Lee County Property Appraiser's

Office provides this Estimator as a service to the public and neither warrants nor

certifies the tax amounts shown herein to be representative of current or future

taxes.

Current Millage Rate:

0.0000

- Millage Rate

-

This is the tax amount per $ 1,000 of assessed property value.

Estimated Taxes with Homestead Exemption:

$ 0

- Homestead Taxes Note

-

Please Note:

The previous owner has until December 31st to apply for an exemption on a

new permanent residence that they owned on January 1st (thus removing the exemption from

this property). The result of removing the previous owner’s exemption will be an increase

in your November tax bill, an increase that may not have been considered when you purchased this property.

NOTE: The Tax Amount shown is an ESTIMATE based upon the Sales Price

you entered and the current ad valorem millage (tax) rate applied to the property.

The actual tax amount for this property may be more or less depending on a variety

of factors including changes to the millage (tax) rate and the inclusion of non-ad

valorem assessments (e.g. garbage, sewer etc.). The Lee County Property Appraiser's

Office provides this Estimator as a service to the public and neither warrants nor

certifies the tax amounts shown herein to be representative of current or future

taxes.