Lee County Property Appraiser's Office

2025-2026

View budget information from previous years.

How the Millage Tax Rates are set:

A Florida Homeowner's Guide to Millage

Property Appraiser’s Budgetary Funding & Relationship to Other Governmental Units

The Lee County Property Appraiser is an elected Constitutional Officer who serves the people of Lee County.

This constitutional office is not a County department under the Board of County Commissioners, but rather it

receives oversight and annual approval for both the assessment of property and the budget from the Florida

Department of Revenue (DOR). The County Commission has no direct control over the Property Appraiser budget,

and with good reason, as this protects the check and balance provided by the independence of an elected

property appraiser. No entity which sets the property tax millage rates should control, in any fashion,

the process which sets the assessed value of property for tax purposes.

The property appraiser serves all taxing authorities: the county commission, school board, cities, special

districts, multi-county authorities, and best serves the public when they are not controlled by any one of them.

In other words, "the fox cannot guard the hen house". Our budget is prepared in accordance with Florida law

to ensure that adequate resources are available to fund the operations of the office. Funding for the property

appraiser budget is based upon fees for services rendered pursuant to

Section 192.091, Florida Statutes. This statute provides that the budget of the office, as approved by DOR,

is the basis upon which various taxing authorities in the county are billed for services rendered. Pursuant

to Florida Statute 195.087, on or before June 1st of each year, every property appraiser, regardless of the

form of county government, shall submit to the DOR a budget for the operation of the office for the coming

fiscal year, beginning October 1st. Note that the county commission pays a higher percentage of the budget

as the State Legislature has discounted the school system and the municipalities from paying their equitable

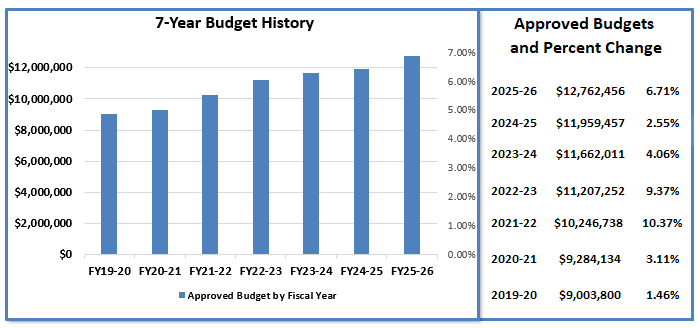

share of the cost. The table and chart below display a seven-year budget history.

Unsurprisingly, the rapid inflation in the cost of goods and services has impacted our budget since 2020,

however, we continue to look for ways to improve efficiency and strive to maintain our position as

consistently one of the least expensive property appraiser offices per capita and per parcel, out of

Florida’s 67 counties. The Office of the Lee County Property Appraiser continually seeks opportunities

to enhance the quality and value of services offered to the taxpayer. The office strives to utilize

new technology and maximize employee strengths and productivity in the most cost-efficient manner. It

is our goal to continue providing the highest quality of service consistent with the expectations of

our taxpayers.

Please feel free to contact our office if you should have any questions.

Respectfully,

Matt Caldwell

Lee County Property Appraiser